The ‘meme’ stock bubble burst: Small investors helplessly embrace a large loss, lose all their savings to retire, regret the wrong decision

- Tram Ho

Frantic developments with the “short squeeze” scheme carried out by the group of investors in the r / wallstreetbets chat room have caused hedge funds to bet prices down. Billionaires like Chamath Palihapitiya, Mark Cuban and Elon Musk have all “contributed” to that dynamic.

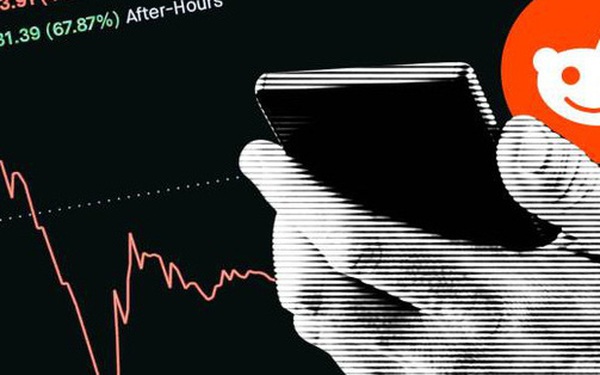

However, by the end of Feb. 4, more than $ 36 billion in the capitalization of 5 companies that had seen the spike since early January have been blown away. This drop took place in one of the most volatile periods of this decade, highlighting the risks inexperienced traders face when it comes to the ease of using free trading apps.

Tori Barry said she used her savings to buy shares of GameStop and the company that ran the AMC theaters by the time the group was near its peak. Immediately, she lost £ 2,500. “We are not big investors,” said Barry, “but it didn’t lose a few million pounds, but for us it was rent, service bill. I don’t know how to get it back.”

Stocks group “meme” lost tens of billions of dollars in capitalization in the past week.

During the time this frantic trend drags on, a few celebrities are also drawn in.

Chamath Palihapitiya – famous investor and CEO of Social Capital, shared on Twitter Jan. 26 that he bought a call option in GameStop shares – a bullish bet, after seeing social media tumultuous. The next day, he said again: “r / wallstreetbets is now the largest hedge fund in the world.”

Meanwhile, Elon Musk posted on Twitter: “Gamestonk !!” on the evening of January 26 when it came to wallstreetbets. During overtime trading that day, GameStop increased by 60%. On January 28, Mark Cuban also cheered for the trend, revealing that his 11-year-old son was making money “following” wallstreetbets. In addition, he also urged buyers of GameStop shares to continue holding.

Shares GameStop has fallen nearly 90% since peaking at 513.12 in the pre-session session on 28/1.

“We have lost too much,” Barry said. “So the only way to get a chance to make money is to keep holding it,” said Barry. She is closely following the discussions on WSB and believes stocks will rebound. She said: “I trust Elon Musk, his tweets will have a big impact. With his cheers, the retail investor will win.”

Even professionals with financial background have been caught off guard by this trend. Michael, an accountant at a company, said he withdrew $ 69,000 from his Vanguard pension fund to buy GameStop when the price fell to $ 230 per share on Monday. However, as stocks continued to plunge, he sold them off and lost $ 42,000.

The number of WSB members increased by an explosion in January 2021.

The 27-year-old accountant said: “I saved it for three and a half years. And in one of my weak moments, I made things worse.” He believes that he will make back the lost money until he officially retires.

Despite the growing losses, many WSB users continue to “team up” to urge others to continue buying this stock. User “TheMostBasedMan” said: “This is not about taking the wisest move, but about turning the tables.”

Such words of encouragement seem to be quite popular on Reddit forums and attract the attention of experts and brokers. They are concerned about the long-term financial losses, which are caused by the explosion and “burst” of the Reddit stock bubble.

Joe Saluzzi, a partner at Themis Trading, said: “They are leading sheep to ‘butch’, adding that billionaires like Cuban, Musk and Palihapitiya are making retail investors trust, they do not understand that these are gambling.

Greg Davies – financial behavior expert at Oxford Risk, commented that people are very good at “deceiving themselves” when receiving both big profits and losses. “It has been a feature of every financial disaster and bubble since the very beginning. Once we want to believe something that will make us rich quickly, we are very good at filtering information,” he said. to underestimate it. ”

Source : Genk