Today I share with everyone some basic knowledge about startups, especially some basic terminology about startup money, common words between investors and startups. When is an additional investment needed …

I will try to share in small articles. Anyone can read it.

- Burn Rate

- Profit (Revenue & MRR & SaaS Quick Ratio)

- Profit with profit ratio (Profit & Margin)

- Churn Rate

- Unit Economics (CAC & LTV)

- Growth rate (MoM & CMGR)

- synthetic

First I will go into the first part is the Burn Rate.

What is the Burn Rate?

Burn Rate is an indicator of how much you spent in the month. In other words, it is also known as the monthly rate of burning money.

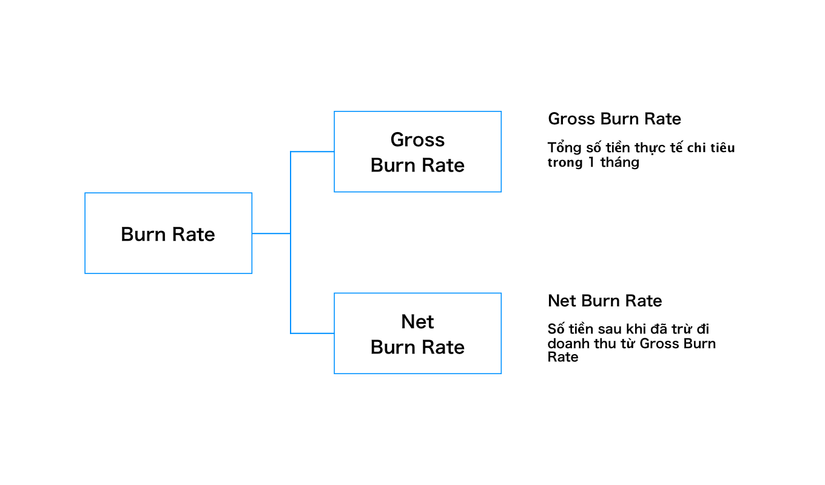

Burn Rate has 2 types. It’s Gross Burn Rate and Net Burn Rate.

- Gross Burn Rate: The actual amount spent in a month (eg employee salaries, server rentals …)

- Net Burn Rate: The amount of 1 month received after subtracting the revenue of that month

Usually when it comes to Burn Rate, it refers to Net Burn Rate. The formula for calculating Net Burn Rate will be calculated as follows:

1 2 | Net Burn Rate <span class="token operator">=</span> Gross Burn Rate <span class="token operator">-</span> Revenue <span class="token punctuation">(</span> doanh thu <span class="token number">1</span> tháng <span class="token punctuation">)</span> |

For example:

The total amount spent in 1 month is all $ 1000. The amount of revenue earned that month was $ 200.

-> So Net Burn Rate = 1000 – 200 = 800 $

What is the Burn Rate with fund mobilization related to?

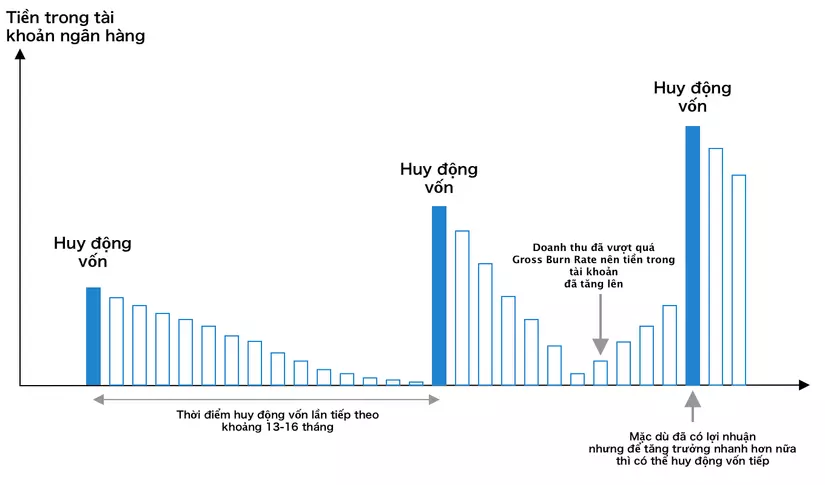

Burn Rate with related capital mobilization as the table below.

The majority of people in the early stages of startup, the Burn Rate rate is quite high (because there is almost no revenue).

The payables are much larger than the revenues, resulting in less and less capital. After running out of money, raising money is extremely important.

The next stage after starting to have revenue, this time Burn Rate gradually reaches to 0. And when it is profitable, Burn Rate> 0

Although profitable, but for faster growth, many startup companies continue to raise capital.

Having captured the Burn Rate, it is possible to know how many months our company will last. The simple formula will look like this:

1 2 | Số tháng có thể kéo dài <span class="token operator">=</span> Tiền còn lại trong tài khoản ngân hàng <span class="token operator">/</span> Net Burn Rate |

Burn Rate with monthly sales

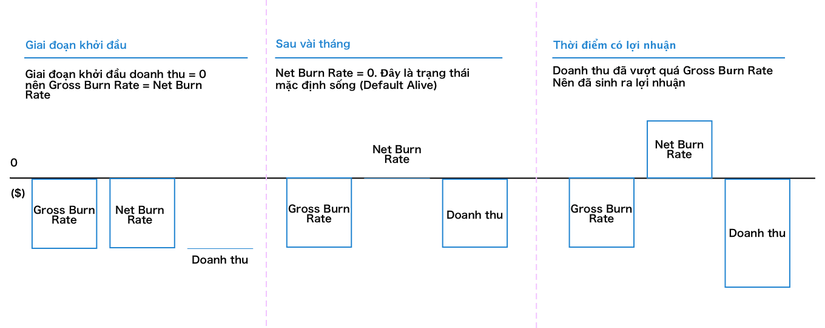

Burn Rate and revenue are as follows:

From the table above we can see, the greater the revenue, the lower the rate of Burn Rate. And when there’s a profit, the Burn Rate will be less than zero.

Basically start-ups are all about rapid growth. While the revenue is not high, increasingly deficient. And then this Burn Rate rate is called Default Dead (default dead).

Therefore, we need to understand clearly ourselves at what stage we are? “Default Dead” (Default is dead) or “Default Alive” (default is live). And need to quickly bring myself to “Default Alive” state as soon as possible.

How to reduce Burn Rate?

In most startups, the cost of personnel (salaries for employees) accounts for the majority of Burn Rate. So to reduce Burn Rate, the easiest is to reduce this cost to the extent possible. Need to optimize human resources in the company, should not recruit too much. Or maybe hire external resources to reduce costs.

The director of Y Combinator has warned that most young founders tend to recruit more people. Because that’s like a company. So please pay attention. Knowing how to make good use of resources in the company is extremely important.

However, a high Burn Rate does not mean it is bad

The high Burn Rate itself is not bad. But the problem here is:

- The capital is no longer there but the Burn Rate is still high

- Burn Rate is high but still not reach the set milestone

Especially the second case. Because if this case happens, raising capital next time is extremely difficult, or it may take a long time to call for capital.

However, if you pay too much attention to Burn Rate, it is likely that the development speed of the project will decrease. So balance it well.

Reference source: https://nghethuatcoding.com/2020/05/09/toan-tap-ve-startup-burnrate

==============

To receive notifications when there are latest posts, you can like my fanpage below: