16-year-old boy cheated Wall Street: Bringing the carpet cleaning company to the stock exchange, blowing up to $ 200 million worth of assets, liquidated assets when bankruptcy was worth just $ 62,000

- Tram Ho

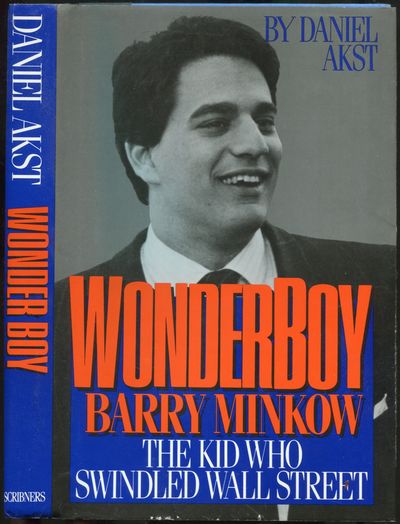

In 1985, Daniel Akst, a former correspondent for the Los Angeles Times and Wall Street Magazine, wrote an article that recounts the admirable story of a talented young entrepreneur Barry Minkow and his carpet cleaning company ZZZZ BEST. he. The media are not sorry to praise, honor the spirit, the aspiration of teenage boys. In the early 1980s, ZZZZ Best became a miraculous business phenomenon, while Minkow was named “Wonder boy” and even “Wall Street hero”.

Two years later, Daniel Akst and even Wall Street were shocked and realized that he had been deceived. What happen?

Barry Minkow.

16 years old starting with carpet cleaning company

Minkow was born in 1966, grew up in a middle-class neighborhood in Reseda, California. From a young age, he was exposed to the carpet industry by his mother and learned that this is a market with very few entry barriers, no license, no vocational training and only requires a small amount of capital to start a business.

At the age of 16, the teenager started his business with the establishment of the carpet cleaning company ZZZZ BEST, in his parents’ garage. However, at the time, Minkow realized how difficult it was to make money from carpet cleaning, from customer complaints to fierce competition.

The company has never done business. Minkow began to seek capital in every possible way. The conditions were even more difficult when local banks refused to loan any working capital because he was too young.

Engage in a scam

Initially, Minkow borrowed $ 2,000 from her grandmother, then stole the pearl ring. Such capital is certainly not enough. He planned a scam, starting with a fake credit card, insurance fraud, writing checks “no.”

In 1985, Minkow opened a “merchant account” account, allowing the company to accept credit card payments. Since then, whenever he needed money, he would add untrue fees to the customer’s credit card account and receive cash from the bank. If a customer complains, Minkow blames the employees for hiring, paying compensation and then cheating again.

Not stopping there, resourcefulness and connectivity helped him convince many people to embark on this scam. Minkow established a fake “Appraisal Service” company with the aim of verifying business transactions of ZZZZ Best and letting its owner Thomas Padgett be the owner and operator.

He also convinced the bank that he had won big contracts from insurance companies to restore damaged buildings to fires. Padgett is the one who confirms, spoofs all documents and contracts. The operation to restore contracts from insurance companies has expanded to the point that sometimes accounts for 90% of the company’s constant revenue.

Great Wall Street

Minkow continued his ambition to bring ZZZZ Best to the stock exchange but the audit phase continued to hinder. An Ernst & Whinney auditor insisted on looking at the company’s most successful recovery contract file, but at first he ignored the request, claiming it was confidential. After that, he sent Padgett to rent a building and repair it to look like a building restored by ZZZZ Best. Minkow and Padgett were once again successful, receiving a “clean” confirmation of the financial health for the company.

From 1984 to 1987, ZZZZ Best’s net income increased from less than $ 200,000 to more than $ 5 million on revenue of $ 50 million. This is due to Minkow always maintaining a fraudulent financial record adorned with fake orders and accounts, attracting and impressing Wall Street investors and stock analysts.

In December 1986, ZZZZ Best officially launched Wall Street. By March of the following year, Minkow’s company value hit $ 64 million, and a month later continued to rise to $ 110 million. At its peak, the company’s market capitalization reached 200 million.

And understandably, Minkow has an extravagant life with huge fortune. Media and media have been constantly reporting, considering him an exemplary image for a young aspirational and wealthy class.

The fox tail

During the stock boom, reporter Daniel Akst, who once gave Minkow a beautiful nickname “Wonder boy”, began to hear about credit card fraud. On May 22, 1987, he wrote an article titled “Behind ‘Whiz Kid’ Is a Trail of False Credit-Card Billings.” (Roughly translated: “Behind ‘Whiz Kid’ is a trace of chemistry.) wrong credit card application. “) The next day, ZZZZ Best stock lost 28% of its value.

The article overturned Minkow’s trick.

Securities investigators started to get involved. People recognize irrational numbers for a small-sized business like ZZZZ Best and carpet cleaning business. Costs, revenue from renovating works are similarly accused.

Instead of working to restore profits, Minkow planned sophisticatedly to cheat, and at the same time, made the company’s debt grow. The initial public offering (IPO) earned $ 13 million from investors but was only used to pay previous lenders and served the lavish lifestyle of young entrepreneurs, similar to the model. Charles Ponzi infamous scam many years ago.

Minkow also spent millions of dollars on fraud, creating fake receivables and then arranging them to look like normal transactions.

Why turn off!

When the scam was cleared, the company immediately went bankrupt. From the market cap of US $ 200 million, ZZZZ Best liquidates its assets for only US $ 62,000. Meanwhile, investors lost more than $ 100 million. In December 1988, Minkow was sentenced to 57 counts of fraud and sentenced to 25 years in prison.

Barry Minkow’s fraud is one of Wall Street’s biggest scandals.

The scandal of ZZZ Best has caused Congress to reconsider the labyrinth of rules of financial reporting regulations, once considered the foundation of the US corporate monitoring system. It also becomes a lifelong lesson for investors and audit agencies about greed, trust and morality in business.

Source : Trí Thức Trẻ