1. What is Payment Gateway Testing

Payment Gateway Testing is testing systems using Payment Gateway. A Payment gateway system is an e-commerce application service that allows users to pay online via credit card (credit card). Payment Gateway will protect your credit card details by encrypting sensitive information such as credit card numbers, account holder details, etc.These information will be exchanged securely. Safe between buyer and seller and vice versa.

In addition to credit card payment gateway, it also allows safe payment via debit card, electronic bank transfers, cash cards, reward points … Some popular payment gateways are Braintree, Authorize.net , PayPal, Bluepay, Citrus Pay, etc.

Some terminology:

1. Merchant – a person or company that sells products or services. Flipkart, Amazon, eBay are some examples of Merchants.

2. Credit Card – Plastic cards can be used to purchase products or services through a credit account. It has a 16-digit card number, expiration date, hologram, magnetic stripe, signature table and Card Verification Value (CVV) number

- Acquiring bank – is a financial institution that maintains the seller’s bank account and allows the seller to accept and process debit and / or credit card transactions on their store.

- Issuing Bank – is a financial institution that issues debit or credit cards from customers. Whenever a customer uses a credit or debit card to make a purchase, the issuing bank will approve or deny the transaction based on the cardholder’s account and transfer that information to the acquiring Bank.

- Transaction – The process of ending to end through which merchants receive money for dealing with customers.

- Authorization – Authorization is required when customers purchase. This authorization is provided by the customer’s issuing bank and confirms the validity of the cardholder, solvency and presence of sufficient funds, etc. Upon completion, the funds are held and the number The balance is deducted from the customer’s credit limit but not yet transferred to the merchant account.

- Capture – In this action, the merchant collects relevant customer payment information and sends a payment / arrest request to the processor. The processor uses this information to initiate a transfer between a customer’s card account and a commercial bank account.

This article will address the following:

- Types of Payment Gateway System

- Testing Types for Payment Domain

- How to test the Payment Gateway: Complete Checklist

- Example Test Cases for Payment Gateway test

- Some issues to consider when buying a Gateway Package

2. Types of Payment Gateway System and transaction flow

2.1 Hosted Payment Gateway:

The hosted payment gateway system directs customers from the regular e-commerce site to the gateway link in the checkout process. After payment is complete, after payment is completed, it will take customers back to the e-commerce website. For such a payment type, you do not need the merchant id, an example of hosted payment gateways is PayPal, Noche and WorldPay.

2.2 Shared Payment Gateway:

During processing, the paying customer is redirected to the payment page and stays on the ecommerce website. Once the payment details are filled out, the checkout process is carried out without leaving the e-commerce website during payment processing, which is easier and, better yet, an example of a payment gateway. Share is eWay, Stripe.

3. Testing Types for Payment Domain

Testing for the Payment Gateway should include:

- Functional Testing: Check the basic functionality of the payment gateway, verify that the application behaves the same when processing orders, calculating, adding VAT by country, etc.

- Integration: Check integration with credit card services

- Performance: Identify various performance metrics such as the highest number of users that can come through ports in a given day and the number of current users

- Security: Need to perform a deep security test with payment gateway

4. Test Payment Gateway like: Complete Checklist

Before performing the test: Collect appropriate test data for fake credit card numbers for maestro, visa, master, etc. Collect payment gateway information such as Google Wallet, Paypal or others Collect portal documents payment with error codes Understand the session and parameters passed through the application and payment gateway Understand and check the amount of relevant information transmitted via query string or variable or session

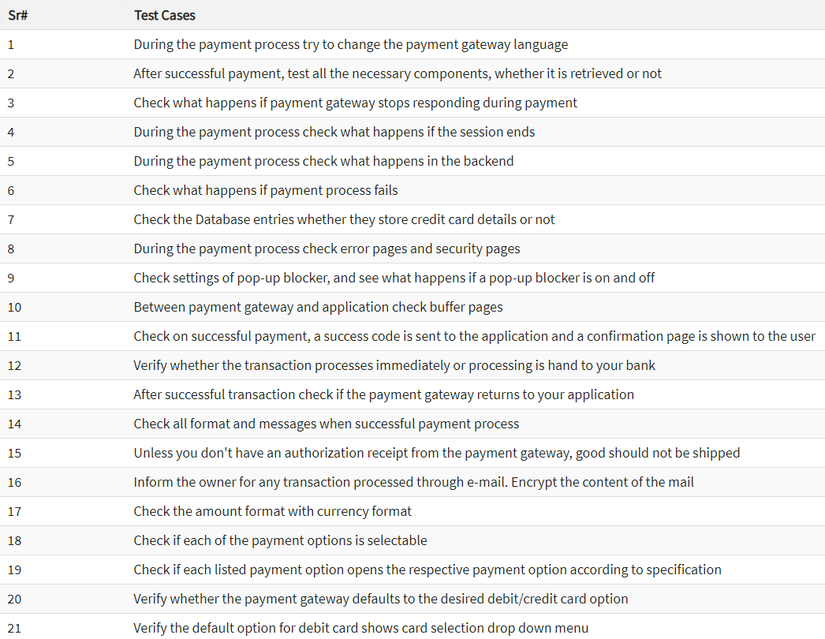

For example, Test Scenarios / Cases for the Payment Gateway check

5. Some issues to consider

- Make sure the transaction is checked from start to finish. In our projects, we have tested and reported many errors related to data collection and data flow from the application to the Payment Gateway. Some specific errors are:

- Customer name information (buyer) is not captured correctly

- The customer’s credit card expired has been incorrectly captured due to an incorrect function but caused transactions to be rejected by the issuing bank on the incorrect credit card information. .

- Duplicate transactions displayed in the Payment Processor

- If the payment fails in a transaction for any reason, an appropriate message will be displayed to the customer. Any error messages that are too technical like ‘Objects are not set to individual or 404 errors can confuse customers and affect user experience.

- For the purpose of verifying post-production release, customers (applicable to business owners) will need to create a direct payment processing account, set up their Merchant ID, etc. Depending on the payment processor is selected, it may take from 2 days to several weeks to set up the account. This needs to be informed by the project manager to the customer in advance with enough time to set up a live account before the application and payment integration of the processor are live.

- If you purchased a shopping cart package, find out about its compatibility

- If the shopping portal package is due, ask the payment gateway provider for a list of supported applications

- The port must provide Address Verification System Protection

- Find out what types of transaction protections are being offered

- Check which debit or credit card type is accepted by the payment gateway you have selected

- Check the transaction fees collected by the payment gateway

- Check to see if the payment gateway is on the form or directly to another page to complete the purchase

Source: https://www.softwaretestinghelp.com/payment-gateway-testing-tutorial/ https://www.guru99.com/payment-gateway-testing-tutorial-with-sample-test-cases.html